In the previous article, I gave you an idea of the types of cards available on the market. Let's see the practical steps to enjoy using plastic and remain debt-free.

1. Use the card to buy something you can afford. This sounds very obvious and yet it isn't at all times. In a sluggish economy such as Lebanon's, consumers are often tempted and enticed to buy something NOW, even if they cannot afford it. The most luring slogan in recent years is the 0% interest rate.

First, there is no such thing as no interest rate. Banks are not caritative institutions. They make money off their customers.

Second, you need to pay close attention to all those charges, such as:

- APR (Annual Percentage Rate) and the interest rate on POS (Point Of Sale) transactions: for example, if the POS rate is at 1.75%, the APR is at 21% (1.75% x 12)

- Annual fee of the card: range starts at USD 75 (classic credit card) per year to USD 550 (American Express Charge card)

- Cash advance fee using the bank's network: ranges between USD 5 to 10, depending on the bank and the network

- Cash advance fee using a different network, in Lebanon or abroad: range between a certain amount and a certain percentage of the transaction amount, whichever is greater, usually not exceeding USD 50

- Foreign exchange mark-up rate: when you pay in a different currency of your card's currency, the charged fee on the transaction can vary between 3.5 and 4% of the transaction value based on wholesale market rates.

Bottom line: do not use a credit card to withdraw cash, especially when in a foreign country.

2. Pay back the whole amount spent during the billing cycle by the end of said cycle i.e. let's say you have spent USD 500 on the 15th of the month and your cycle ends on the 16th, pay up the total of the USD 500 before the next cycle starts as per your bank's due dates. All banks provide a grace period ranging between 20 and 35 days, during which no interest is charged on the amount due. The amount spent after the cut-off date can be paid off at the next billing cycle.

If you cannot pay back the complete sum that you have enjoyed spending, pay up as much as possible to minimize the interest rates on the outstanding balance. If you have multiple cards, pay off the one with the highest interest rates and only the minimum on all other cards. Repeat until you have paid all debt off. If you hold 2 or more cards with the same interest rates, make the larger payment on the card with the larger balance to minimize interest rates.

3. Finally, automate your payments to avoid missing out on due dates.

Meanwhile, keep collecting miles, points, and perks. And remember to keep a clear vision of your debt board. Wait, what? Yes! Just like you budget your payments and you organize your financials, it is highly recommended that you organize your debt. While enjoying the rewards generated by your spending. You will surely feel elated when redeeming your spending/loyalty for a trip or a gift that you do not have to pay for!

If you are hesitating about which credit card to apply for, check https://yallacompare.com/lbn/en/credit-cards or drop me a message. I will get back to you as soon as possible.

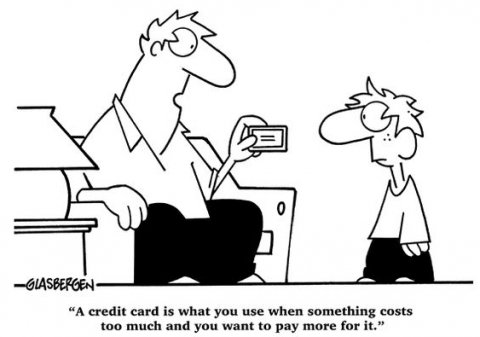

Link to the cartoon on what is a credit card here