Link to major cryptocurrencies pic here

Since 2009 and the creation of Bitcoin, maybe the most known of the cryptocurrencies on the markets and the one that has the highest market capitalization, several other currencies have gradually seen the light. I will name a few here: Ethereum, Ripple, Litecoin, Monero, Namecoin, Nem, Peercoin, Dash. Only a few of these currencies didn't last thru the years. It is very important to note that a couple of the currently inactive cryptocurrencies were deemed to rely on Ponzi schemes and many times, cryptocurrencies can be deemed to be fraudulent. This is not always the case as the core idea behind cryptocurrencies remains to provide consensus by the members of the said community who need to verify other miners and their transactions. Let me clarify the terminology for those who are not familiar with this lingo.

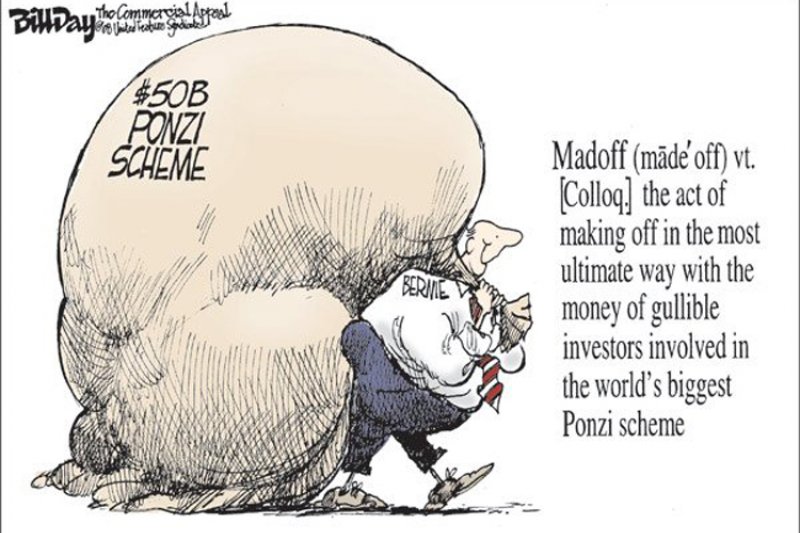

What is a Ponzi scheme? (Investopedia video here) Named after Charles Ponzi in the post WWI era, it is possibly not the first account of such an investment fraud. And with developing technologies, scams also evolve. The game plan is fairly elementary: the swindler convinces investors they will receive high returns with little to no risk and what he/she does is simply to finance oldest contributions with newer investments. There are in fact no profits recorded. As long as regular inflow keeps being registered, little to no investigations will be made and the crook can get away with their trickery. A more recent example of Ponzi scheme is the case of Bernard Madoff who falsified trading reports to show profit earned on investments that didn't exist. You can read more on the Madoff instance here.